How To Integrate Your Financial Planning Software with CRM

Quick Summary: Learn how to connect your Financial Planning Software with Financial Advisory CRM software to increase productivity, improve client relations, and streamline operations. Know the benefits, best practices, and processes to optimize workflows and deliver more intelligent financial advisory services.

Introduction

Financial advisory firms are more likely to use a variety of technology platforms to address clientele relationships, monitor investments and build financial plans. Although these tools are critical, operated in isolation they can cause inefficiency and gaps in client service. By integrating financial planning tools with CRM systems, an advisor can streamline their practices and workflows, have greater access to client data to gain a more rounded view of the client and offer a more complete advice process.

Integration makes the flow of client information smoothly amongst platforms and, therefore, it reduces the chances of error and duplication. Integrating the financial planning tools with CRM systems enables their advisors to understand client profiles as well as their account activity and current interactions comprehensively. This facilitates a more efficient process and facilitates better decisions throughout the advisory practice.

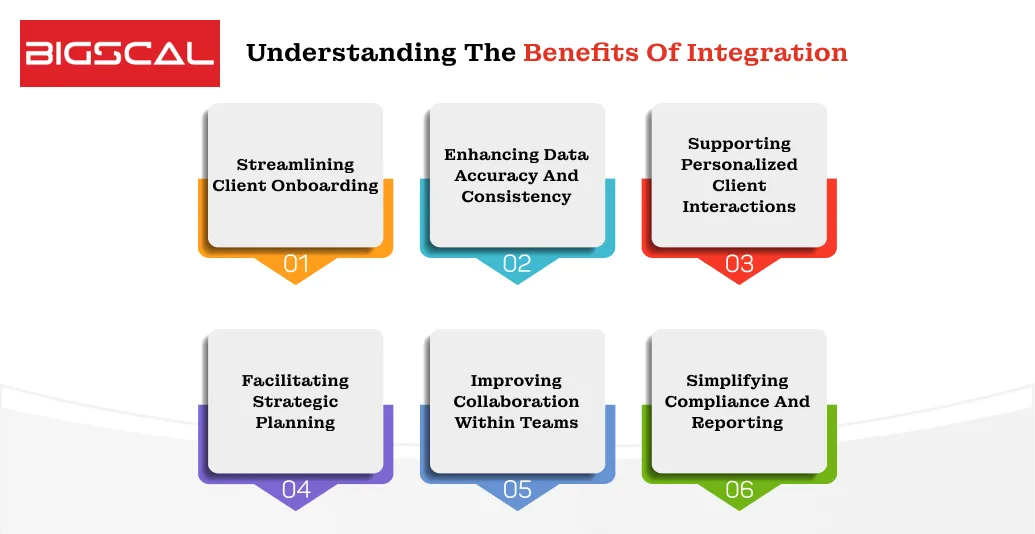

Understanding The Benefits Of Integration

The benefit of integrated financial planning software and CRM offers invaluable attractions to advisors. It enables a centralized database where the client objectives, portfolios and past communication records will be found in a single point. This is to make sure that all recommendations are found on accurate, and current information.

The integration also allows the advisors to automate their routine tasks, like updating the client records, generating their reports and reminding them of the follow-ups. When CRM for financial advisors is combine with planning software, professionals are able to devote more time to client relations and prudent advice and focus less on administration.

Streamlining Client Onboarding

Client onboarding can be time consuming as it typically involves requesting information, creating an account, and early planning. Integration of financial planning software and CRM would make this task easier because it would automate the process whereby client details in the software are import in the CRM system and the appropriate fields will be filled.

This streamlined method is not only time-saving but also minimises error due to manual input. Clients go through a less hectic onboarding course, and advisors can spend more time explaining to the clients what to do with their money and how to achieve their objectives.

Enhancing Data Accuracy And Consistency

Having the right and consistent data about the client is essential in giving financial advice. Failing to integrate the financial planning programs and CRM mix, inconsistencies may arise thus causing confusion or erroneous suggestions. Integration provides that changes made in one system would be synchronised in both platforms.

Compared data can enable advisors to compile reports and forecasts with accuracy. It helps to enhance communication among advisory teams since every team member can be confident in the same information when dealing with clients. With the best CRM software and integrated planning tools, a financial advisor can sustain data integrity and enhance the efficiency of catering to clients.

Supporting Personalized Client Interactions

Integration enhances the ability to personalize client interactions. Using knowledge stored in financial planning software coupled with existing communication profiles captured in a CRM system, advisors can be at the right place at the right time with the right advice.

And when a client’s investment performance variance or a life event occurs this integrated system can provide alerts and context and there is ability to proactively reach out. This individual treatment reveals that the company is concerned and strengthens the client’s confidence, as he or she feels noticed and known.

Facilitating Strategic Planning

Financial advisors tend to use extensive analysis in developing long running strategies on behalf of their clients. Introducing an integral environment of financial planning software to pursue CRM systems, it is now possible to gain access to customer financial histories, goals, and contact information all of which can serve as the starting point of strategic planning.

Advisors will be able to model and simulate various scenarios, monitor the progress made against targets, and make alterations to recommendations using real-time data. This is done proactively in order to ensure that strategies are maintain in line with the client goals and market conditions hence improving overall advisory performance.In practice, many advisory firms complement this approach by working with partners that offer comprehensive wealth management services, helping align financial planning, investment oversight, and long-term client objectives within a single advisory framework.

Improving Collaboration Within Teams

In a number of advisory firms, teams have several members who come in contact with the same clients. The integration guarantees that each person has access to the most current information, portfolio updates, planning documenta- tion, and history of client communication.

Through illuminating collaboration, the advisor does not have to make duplicative efforts and the clients will have consistent and corrective advice. The degree of internal participation and interaction of the team members can be optimised so that they can coordinate follow ups and share experiences and make more inform recommendations quicker thus improving work flow between them and working clientele.

Simplifying Compliance And Reporting

To be finance advisors, one has to comply with regulatory standards, keep extensive documentation and provide quality reports. Integration of planning software and CRM Consulting Services can make compliance very simple since all the data that you require can be store in one place.

With centralize records, advisors are able to produce reports easily and in a short time, monitor the activity of their clients and know that all their regulatory requirements have been fulfilled. This simplifies administration and gives advisors the opportunity to dedicate themselves to more strategic advisory activity as opposed to document compilation.

Conclusion

CRM systems can be integrate with financial planning software to empower financial advisors with an effective set of tools that helps them accomplish their tasks with more efficiency, accuracy and customer satisfaction. With a streamlined platform, advisors can simplify onboarding, make data consistent, provide personalised client relationships, enable strategic planning as well as enhance teamwork.

Opting to use a CRM financial advisor in conjunction with top-notch CRM software guarantees the ease of integration, high reliability, and the ability to manage the needs of the contemporary advisory firm. Integration will help advisors operate in a more comprehensive and proactive manner, deepening client relationships, and facilitating business growth in the long-term.