Top Exciting Fintech App Ideas For A Startup In 2024

Quick Summary: This blog highlights innovative solutions transforming the fintech industry. This blog is about the visionary strategies redesigning finance and the effect of that. Find out cutting-edge Fintech apps ideas that could be preferred by startups in 2023! Read this blog to get valuable insights that will help you to embark on your entrepreneurial journey.

Introduction

The smartphone has become so embedded in our daily lives that we constantly try to use it for convenience and productivity. Financial technology trends have transformed nearly all financial procedures into fintech apps. A large part of this shift can be attributed to the pandemic.

Therefore, the Fintech application developers have their good investment opportunities due to the fact that the number of financial technology applications in demand is ever-growing. Extending the adoption of their technology, they continue to enhance the quality of life by assisting the healthcare sector to achieve additional milestones.

Through this blog, we focus on the ideas of Fintech App Development development services that startups must consider in 2023.

Starups can onesick these ideas to Boolean a fintech app of 2023

In this blog, we will emphasize the Fintech App Development ideas for startups to consider in 2023. But before that, let’s look at the current fintech market situation.

FinTech: A Brief Ideation

Fintech, the combination of finance and technology, has evolved since the 19th century. With digitalisation, traditional financial institutions have shifted from analogue to digital methods.

Today, Fintech Software Services companies help banks and financial institutions to serve financial services digitally.

Furthermore, FinTech streamlines all financial services such as online banking, e-trading, cryptocurrencies and digital payments etc and makes them more innovative, transformative and cost-effective.

FinTech is one of the shining beacons of innovation in the fast-evolving world of modern finance.

Additionally, it creates new opportunities, elevates growth and provides an incredible user experience. To succeed as a startup, you must invest in ROI-driven FinTech solutions and products that disrupt traditional financial services.

In the competitive world, the FinTech industry must innovate to avoid losing customers and failing to survive. Therefore, it is crucial to embrace innovation to get success in the rapidly changing financial landscape. Consider fintech development outsourcing for app-building assistance. They can provide expertise and resources to build your app efficiently.

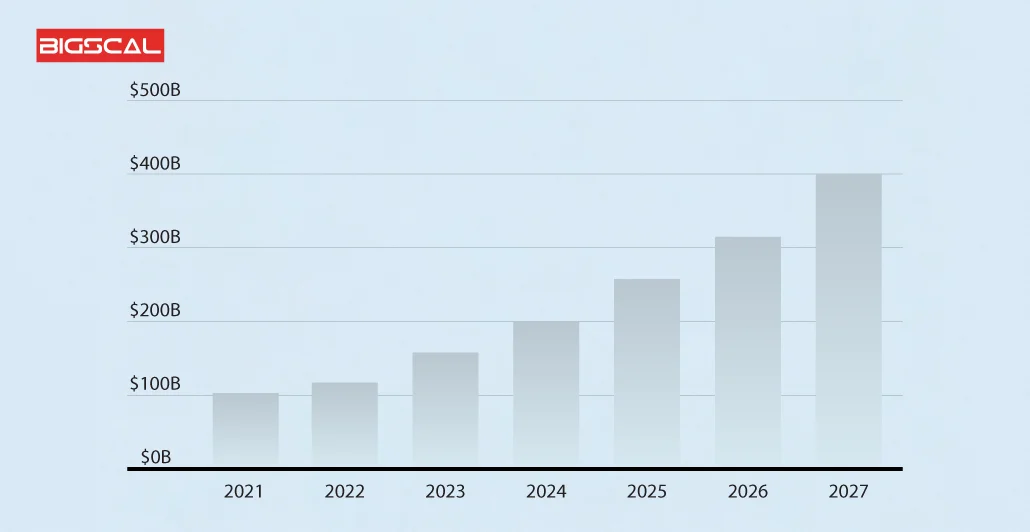

FinTech Market: A Statistical Overview

- According to a report, Global FinTech will reach around $500 billion in 2027.

- From 2022 to 2030, it is predicted to grow at a CAGR of 35.3%.

- Since 2015, FinTech investments have grown by 3.5 times, according to KPMG.

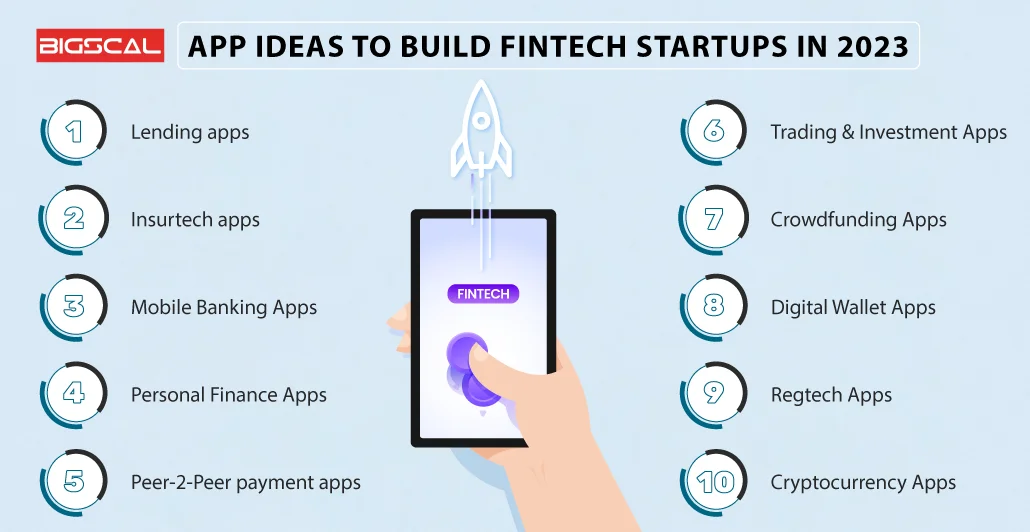

App Ideas To Build FinTech Startups In 2024

Below are some inspiring fintech app ideas that will encourage you to join the wave of innovation.

1. Lending apps

The COVID-19 pandemic lockdown has led many organizations and individuals to look for quick loans to fulfill their needs.

Furthermore, lending apps leverage AI and big data analytics technologies to streamline the loan assignment process by analyzing data, credit history, behavior patterns and shopping activity to check whether a person is eligible for loans.

Additionally, these high-tech FinTech apps have transformed the lending industry. You can build a payday loan app, peer-to-peer lending platform etc. However, there are endless fintech app ideas, it’s up to you to figure out what suits your business best.

MoneyLion is the best example of a fintech lending and saving app. Also, this lending app helps individuals handle their finances and have positive

Features:

- Lender profile authentication

- Direct funds transfer

- No transaction charges

- Automated CIBIL score checking

Pros:

- The loan lending app provides personalized loan options by checking user credit profiles and borrowing needs to offer an outstanding customer experience.

- These lending apps automate all the loan approval approaches and save time and costs for lenders.

2. Insurtech apps

The pandemic has triggered a surge of new fintech apps focusing on affordable insurance plans.

Insurance apps play a significant role in the FinTech mobile app development industry. Startups can use these ideas to create a fintech app in 2023.

Also, these apps slightly improve the insurance accomplishment that comprises AI technologies and data analysis where they gather, process, and analyse the user’s data and use it to detect risks.

Furthermore, insurers can also utilize fintech apps that simplify the processes, such as creating a platform for the provision of services that are of high quality and are customer friendly.

Allstate Mobile does a nice job as a kind of the car insurance app, since it provides with the opportunity for its users to lodge and claim your insurance within a few minutes and has many other features of use for car owners.

Allstate Mobile Is in my view a stand-out case of an app which can be used to submit and claim car insurance very quickly and the app also provides other car-owner friendly features.

Features:

- Premium e-payment.

- Online policy purchase

- Real-time update

- Document Storage Option

- Customer service chatbot.

Pros:

- It is a system that assists customers in reducing time and effort to process the claim, which attracts more people to use the app.

- Increases the profits of insurance companies. through: Increases revenue of insurance companies.

- Such apps being highly popular among youth motivate more younger users.

- Although other types of finance do have competitors, this one is basically the only one.

3. Mobile Banking Apps

Mobile banking apps are one of the better phitech app ideas startups for banks and financial institutions.

Hence, the users could perform multiple tasks on various tabs instantaneously. Today majority of financial sectors observe utilizing digital tools in the continuation of their operations.

And this will make users check their account balance, the conduct of money transfers, pay bills and deposit cheques, among others.

The Banking app is a go-to money management solution even from one end of the world to the other just by clicking a few buttons. In addition to all these tasks, they can save time from going to an ATM or branch bank for money transactions.

Another feature is the fintech apps that provide secure services which are fingerprint or face recognition for confirming the customers and are used by them to disable services in case of card loss or theft.

Thus, countless folk prefer to resort to mobile banking apps without a need to helao a bank in person as it is more convenient and has easier functions.

Features:

- Online bill payment option.

- Account Management Option.

- Instant fund transfer facility.

- Investment & lending tools.

- Branch locator.

- Card (Debit/Credit) management.

- 24/7 Customer support.

Pros:

- These apps provide more marketing opportunities for finance sectors.

- Virtual banking options can entice more people to a particular bank.

- Assist banks in selling their products to clients.

4. Personal Finance Apps

For startups, creating a personal finance app could be a lucrative finance app idea. People often find it difficult to manage their finances. Therefore, small businesses and professionals are increasingly using personal finance apps.

This app helps users keep track of their daily expenses, savings, and assets. Moreover, users can track their periodic payments and loan premiums with the help of these apps. As well as helping customers make informed financial decisions, they also provide financial education.

Features:

- Budget tracking tool

- Automatic bill reminders

- Investment tracking option

- Savings Monitoring tool

- Expense categorisation

- Credit score monitoring

- Investment recommendations & retirement planning

Pros:

- Personal finance apps provide valuable insights that can assist people in making better financial plans.

- Users prefer personal finance apps because they automate the expense tracking process, making it convenient and time-saving.

- Fintech apps are highly preferred by shopkeepers, small entrepreneurs and middle-class professionals.

5. Peer-2-Peer payment apps

A peer-to-peer payment app might be a good idea if you are looking for innovative yet profitable FinTech app ideas. Furthermore, Individuals can transact seamlessly and securely through peer-to-peer apps, using just a few taps on their mobile devices.

Younger generations prefer digital payments due to their convenience and speed, and these apps have become increasingly popular in recent years. Additionally, users use these apps to transfer money instantly.

People are now transferring money through peer-to-peer apps. A customer can transfer funds directly from his or her account to the electronic wallet of a recipient through these apps.

Rather than relying on traditional banking methods, users no longer need to wait for a transaction to complete.

Additionally, apps like these allow users to connect their bank accounts and digital wallets.

Features:

- Dynamic interface equipped with intuitive menus, buttons, and a navigation system.

- Transaction history options.

- Linked-accounts option.

- Real-time notification alert.

- Payment request option.

- In-built QR code.

Pros:

- These peer-to-peer fintech apps lower currency conversion rates, encouraging customers to prefer these apps.

- The transaction fees for these apps are low or none at all. It attracts users from all classes to prefer it.

- P-2-P fintech apps have excellent security features and prevent data breaches.

6. Trading & Investment Apps

The FinTech app ideas for startups today include apps for share trading, investment, and stocks.

In addition to supplying data about funding possibilities and market information, these apps also provide get entry to to investigate gear, studies cloth, and other sources that could assist investors make informed choices.

Furthermore, apps for trading and investing integrate AI, blockchain era, and system studying algorithms. These algorithms allow investors to keep away from mistakes.

Additionally, Users can advantage from these apps by using making knowledgeable funding selections and growing their wealth through the years. The shift closer to digital funding structures has multiplied as purchasers increasingly are seeking for convenient approaches to manage their budget remotely.

Features:

- User-friendly interface

- Real-time market data

- Multiple investment alternatives

- Research & analytical tools

- Automatic investment

Pros:

- Share buying and selling is a popular preference for talented investors, businessmen, and personnel. These apps will guide novices to get right of entry to the percentage marketplace.

- Trading and investment apps help users to understand the stock market.

- These apps will gain more users if investing is made easier and faster.

7. Crowdfunding Apps

Crowdfunding fintech apps help customers to raise funds for their project, cause, or venture by requesting donations from people digitally.

These fintech apps provide an excellent platform for fundraising such as loans or grants.

In the past few years, these FinTech app ideas have succeeded significantly. Furthermore, fintech apps can be utilized to prove their startup idea to investors: by posting their idea on a crowdfunding platform, they can see quickly if potential investors are interested.

Additionally, these crowdfunding apps are gaining massive popularity in recent years, and this trend will continue

Features:

- Multiple funding options

- Goal-tracking feature

- Social sharing option.

- Communication tools.

- Faster payment gateway.

- Communication tools.

- Security features.

Pros:

- Nowadays, people use smartphones more than the web, Therefore, startups can draw more mobile users to use these apps.

- It becomes easier for NGOs and welfare societies to raise money with the help of these fintech apps.

- Crowdfunding apps are a powerful tool for businesses to validate their product ideas in the market. Therefore, startups can also prefer these apps to understand market interests.

8. Digital Wallet Apps

Coming up with mobile money wallet app is a good idea of fintech that will benefit start-ups. Moreover, this app helps its customers to pay online, store their data and handle their finance using their personal gadgets.

Today, many people would prefer to use smart phones for payments as they are convenient, safe, and easier for them than before when traditional methods were used.

Furthermore, plastic money is being used much less as digital wallets have greatly expended wallets. On the other hand, the payoff would be more delightful if the FinTech companies rolled out coupons and cashback rewards for digital wallets. In the short run digital wallet applications could grow by more about 2 times.

For years, digital wallet will be a trend and will increasingly widespread with its improvement and upgrading

Building a digital wallet app is an excellent fintech app idea for startups Furthermore, these fintech apps help customers to make payments online, store information, and handle their finances from their electronic devices.

Features:

- Payment options.

- Multiple currency options.

- Cross-platform integrations.

- Loyalty programs.

- Budgeting tools.

Pros:

- Digital wallets are highly secure and prevent fraud.

- Customers can purchase products online securely.

9. Regtech Apps

The regulatory FinTech app assists businesses to follow rules and pay taxes correctly, making it easier to comply with regulations.

Furthermore, Regtech (or regulatory ) apps leverage technology to automate and streamline compliance processes.

Additionally, Regtech apps optimize businesses’ operations and help them comply with regulatory requirements, reduce compliance costs, and reduce overall costs.

Features:

- Compliance automation.

- CRM integration

- Risk management tools.

- Data analytics tools.

- Security features.

Pros:

- Regtech apps automate compliance procedures, thus helping businesses save costs and time and improve overall productivity.

- Regulatory compliance is costly and time-consuming. Regtech apps reduce manual work and save costs by automating compliance methods.

- Regtech apps gather and research compliance data and provide businesses with some helpful insights that help them to recognise the areas that need advancement.

10. Cryptocurrency Apps

Cryptocurrency apps are one of the best FinTech app ideas for startups. Consider leveraging this fantastic blockchain innovation for your startup. Cryptocurrencies are digital assets that are protected by distributed ledgers.

Furthermore, as a startup owner, you can get into these highly demanded, secure and efficient crypto transactions and get a commission for every trade.

Also, you can use these compelling fintech app ideas as an opportunity to establish yourself as a leader in this booming cryptocurrency business and embark on your entrepreneurial journey.

Cryptocurrency apps have positive growth opportunities as the adoption of cryptocurrencies continues to grow

Currently, many people are investing in the cryptocurrency market. Therefore, there is a huge demand for user-friendly cryptocurrency apps that simplify these transactions. You also need to check for App development cost.

Features:

-

- Real-time updates.

- Security features.

- Wallet Integration.

- Multiple payment options.

- Trading tools.

- User-friendly interface.

Pros:

-

-

- FinTech apps can increase the user base of startups.

- 24×7 customer support will draw all investors to use this app

- It provides a fast and secure trading approach.

-

Final word

Hopefully, this fintech app development guide helped you to get some thriving ideas for startups. A wide range of FinTech solutions are available to consumers and businesses, including mobile payment tools, investment platforms, and digital lending services. For your business to succeed and sustain, it is crucial to pick the right idea that aligns with your strengths, interests, and market demands.

Several challenges and opportunities exist within the FinTech arena that requires strategic planning and thinking.

If you’re looking to hire a fintech app development service or need an idea to turn into reality, Bigscal can help.

Bigscal is a leading Fintech software development company. Our team of talented and adept developers can help you realize your vision. With Lean MVP methodology, we focus on quickly releasing a minimal viable product and refining it. We’d love to hear about your plans.

Contact Bigscal today!!!!!!!!!!!

FAQ

What are fintech apps??

Fintech Apps are the mobile applications that apply technology to provide financial services, such as Mobile banking, payments, investment, budgeting and lending while opening up for users, so they are more convenient and accessible.

What is the outlook for fintech in 2023?

It is expected that the fintech market will consolidate in 2023 with the convergence of players in digital assets, payments, and finance and capital markets platforms, especially in the trade finance industry.

What are the latest growing areas in fintech?

Undoubtedly, AI technology will shape the future of fintech. Banking, payments, investments, risk management, and more can be revolutionized by artificial intelligence and machine learning.

What are the banking trends in 2023?

The digital banking industry is reshaping itself thanks to trends such as mobile banking, artificial intelligence, chatbots, and cryptocurrency· A growing number of innovations are set to shape the banking industry in the next few years, including personalized banking, augmented reality, voice banking, and cybersecurity.

What are the benefits of a fintech app?

The benefits of a fintech app include convenient access to financial services, quick and secure transactions, personalized money management, seamless integration with other platforms and enhanced financial literacy.